Talent Attraction and Retention

A One Wealth Map Company Service

We are not an employement or placement agency

Attract and Keep The Best Talent In Your Medical Practice

As a medical practice owner you face increasing challenges to balance your lifestyle and increase your income.

After Covid and a massive inflationary increase - it has become a major challenge for medcial practices to find, attract and keep the best talent.

Welcome To a New Innovative Software to Help You Attract and Keep Your Talent

With websites like salary.com and glassdoor.com it is not uncommon for your talent to scan what others are making in the same position

It costs on average of six months salary to hire, onboard and

train a new team-member

If you are paying someone $80,000

a year, it costs you $40,000 to hire, replace and retrain a new person

What Talent Wants

To Attract and Keep The Best Talent You Have to Offer The Best

In todays world of competitive medical talent a practice that needs to grow and profit has to have the best talent.

Based on 40+ Years in working with Medical Practices

We have found the following facts

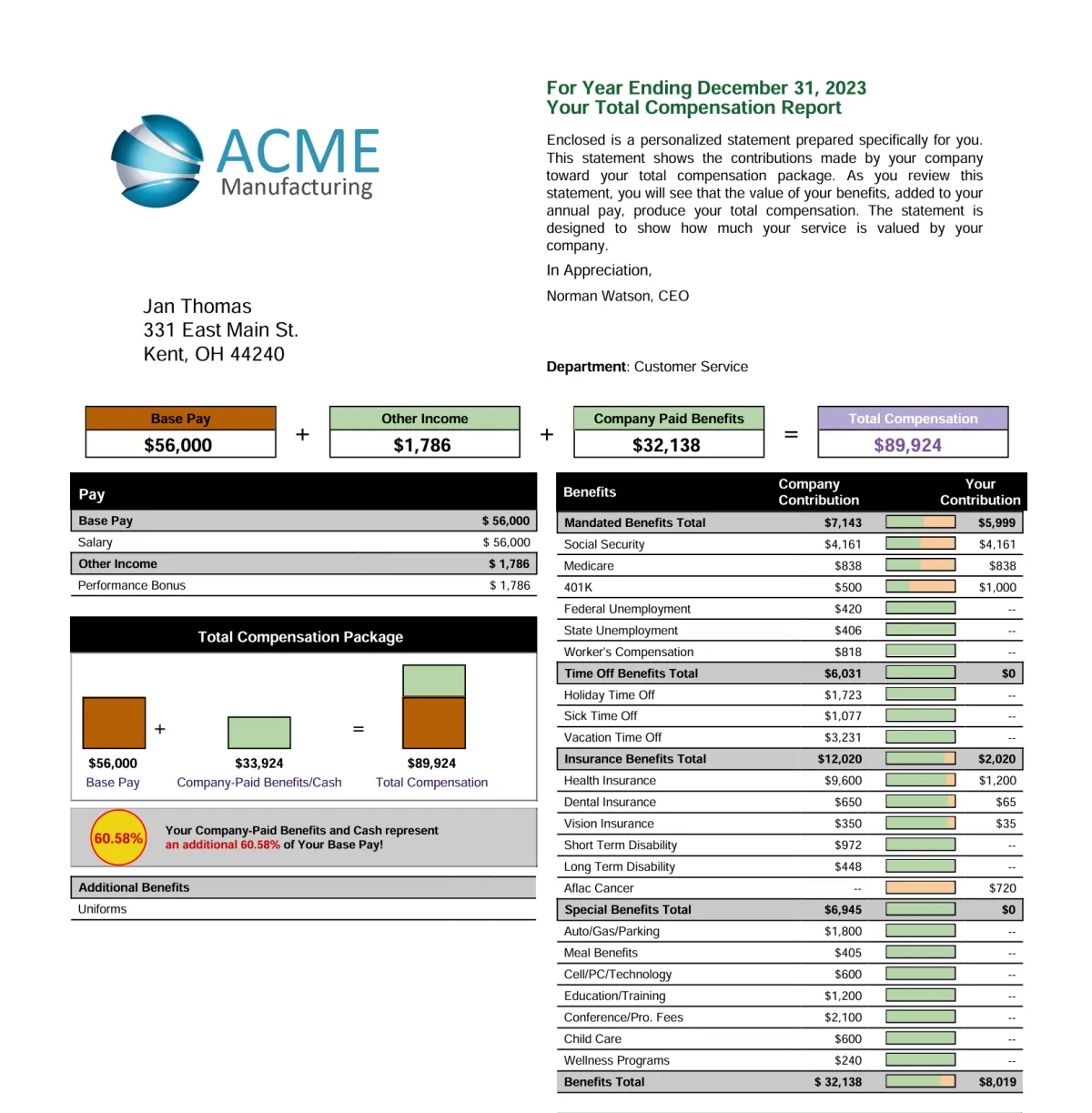

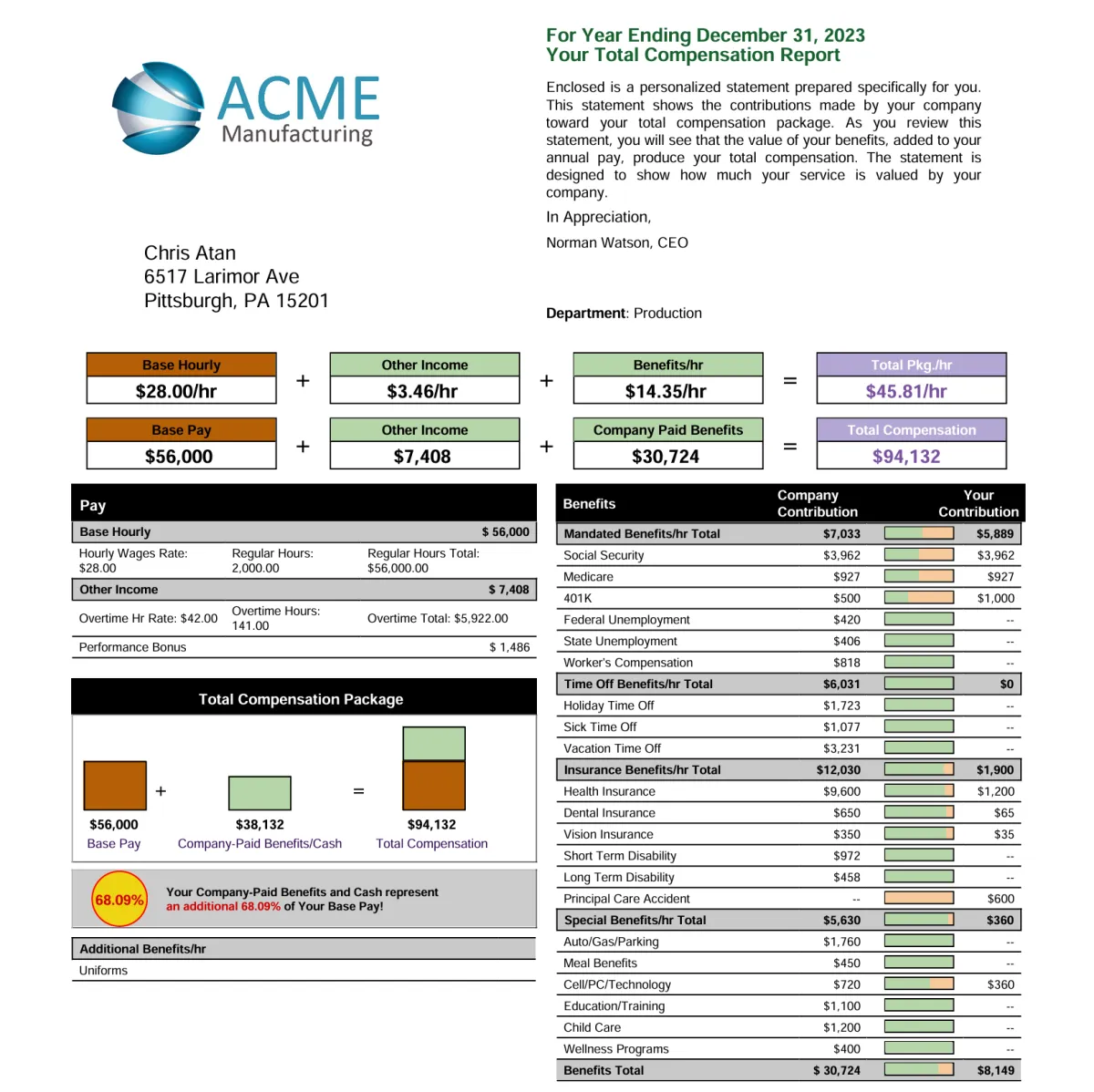

Employees don't know the real cost and value of their compensation package beyond just what shows up on their paycheck?

*90% of employees don't know how to calculate the total value of their compensation package

*90% of employees jump jobs thinking the new job will pay more without knowing what they are already getting

*90% of employees check websites and talk to other people in their field to find out if they are underpaid.

90% of Employees

Search out what others are getting paid in the same job title

90% of Employees

Will talk with co-workers about their pay and benefits

17% of your Employees

Will leave your employement based on their base salary and never really know their true compensatino package

The Total Cost of a Team Member

What Are The Potential Costs For a Team Member?

For most practices - you are providing some of all of these benefits.

Do your team members really know what it costs you as the owner and what the benefit is to them - probably not.

Salary Base

Base salary is the starting value that 100% of team members make a decision to chose your practice

Bonuses

Bonuses are important but most employees don't use this as a decision. However, if you have paid bonuses, the employee only sees their paystub bi-weekly or monthly. While they usually think a bonus is nice, they don't depend on them.

Sick Days

Sick days are an undervalued and hiddent expense to the practice. Paystubs don't show the actual cost to the practice for the cost of sick days.

Paid Time Off

Like sick days, PTO is almost never valued and considered in chosing a job or staying with a job. PTO has a large cost to any practice that can be valued with the total compensation package

401-K

i401-Ks are almost an expectation of every job now. However, for any 401-k the practice has a mandatory contribution. In addition, most 401-ks have an annual administration fee that can be shown as a per employee cost and included in total compensation.

Education and Certification

When a practice agrees to pay for registration or even CMEs for team members, the cost should be shown as a part of the total compensation.

Health Insurance

While not every practice provides health insurance, if you are, the cost of administration in addition to the cost of the insurance should be shown as total compensation

Pension

If you are providing a cash balance plan, profit sharing plan or a 412e or 412i plan above an beyond the 401-K this cost should be shown as the total compensation

Life, Dental, Vision

Like health insurance, the cost and administrative costs of the plan should be shown as a total compensation benefit

Training and Resume Improvement

When you train an employee in a specialized task or operation, this should be shown as a benefit. Many employees use practices to gain experience and training to prepare them to look for another job. This is a benefit the employee takes with them but has a cost to the practice and should be shown as a part of the total compensation benefit

Travel and Conferences

IIf you send a team member to a conference this should be shown as a part of the employees total compensaion

FICA-FUTA-SUTA

Most employees don't see or understand that the company contributes to their Social Security and Medicare benefit costs. These costs can be expansive and costs the practice a lot of money. The Employee takes those benefits with them and these costs should be shown on their total compensation

The Hidden Costs Of Labor

What an Employee Sees

$100,000 Annual Salary

401-K match of 4% = $4,000

What the Real Cost Is

$100,000 Annual Salary

401-K Match of 4% = $4,000

FICA Company Contribution

$7,650

FUTA and SUTA -

$2,100

If two weeks a year PTO = $4,160

Health Insurance Costs = $6,500

The Employees View Of Their Total Compensation

$104,000

The Real Total Cost of Compensation

$125,010

Book An Appointment Now

Our Simple Process

Our process is simple and does not require any work on your end. We will obtain all the data needed and provide the final reports to you for review.

Book a short 15 minute discovery meeting

The meeting will confirm how you want to represent your total compensation reports to your team

We connect with your bookkeeper or accountant

We take all the work off your back. With your bookkeepers or accountants help, we complete a spreadsheet with the current costs and benefits

We do all the work to input your team members total compensation to our software

We complete all the set up, entry and creation of your Total Compensation Reports

We deliver the Total Comp Report to You

We deliver the reports to you for final review. You decide who and when you deliver the reports. You can decide on whether we create quarterly, semi-annually or annually to each of your team members. You can also ask us to create a job posting Total Compensation Report to assist you in hiring the best talent.

Book An Appointment Now

About Company

One Wealth Map specializes in working with Medical Professionals and Ultra-High Net Worth Individuals and Business Owners

Frequently Asked Question

What Perks are not included in an Employees Paycheck?

7 Hidden Perks Not In Employee Paychecks

Reasons our employee compensation software can help your business.

History suggests that few small to medium-sized companies report little more than one-third of the benefits they offer their employees.

In most cases, the only report an employee gets on the cost of fringe benefits is called a "Pay Stub". Consequently, many employees think their benefits and perks amount to just 10 to 15 percent of their total compensation.

The truth is, benefits and perks can represent 40 to 60 percent or more of an employee's total compensation.

If you're simply looking at a pay stub, you probably aren't fully aware of your company's benefits.

The question becomes: How does an employer really show employees all of the benefits they receive?

Our total employee compensation software can show you.Total compensation software can reveal benefits that employees may not realize that they receive including:

Personal use of a company car. Employees who drive company cars (or take trucks home at night) are oftentimes given a car allowance or they have their car payments paid directly for them.

Either way, those costs can add up to $4,000 or more each year. Add the cost of automobile insurance and fuel, and the number significantly increases.

Vacation, holiday and sick time. While an employee can look at his or her compensation report and see an hourly or weekly rate, they oftentimes can overlook their paid time off. Everyone takes this for granted, but if one of their choices is self-employment, who pays it then?

Cell phone and other technology assistance. Factor in minutes used, possible roaming charges, text messages, and your bill can add up. Since just about everyone has a cell phone these days, offering employees this perk can save them more than $500 each year.

Free parking. Work downtown or in a busy business district? The price of parking can be astronomical. When companies offer free parking (even if only because you located the business in the suburbs) or pre-tax dollars for employee parking, it may be easy to forget how much money an employee saves per year. Thousands?

Free or subsidized meals. Does your employee entertain clients over a meal? Do you bring in pizza lunches on Fridays? Do you have an open vending machine or free coffee? Highlighting these delicious perks can help your employees add up how much money they save each year.

Holiday bonus. Perhaps employees don't remember a holiday bonus in last year's compensation, but they should. This benefit is, of course, not an employer’s obligation. If your company provided a holiday bonus, employees should be aware of its impact on annual compensation.

Education. Many employers pay for enrichment courses and seminars, bring in trainers, support associations that provide education. Have you sent an employee to school or paid a percentage of their tuition? These are giant strategic investments in their futures! Why not highlight that in their total compensation report?

Sure, we've all seen pay stubs highlighting Social Security, pension, 401(k) plans, and various health and welfare insurance programs.

Large companies have standard total compensation reporting products and services cost-effectively available to them.

But before you let a valued employee walk away from your company because he or she thinks they’ll get more money else, where total compensation software should be considered.

Total compensation reports are effective morale boosters, and now they're very inexpensive!

Our software can help. Our self-service easy-to-use total compensation reporting software helps small employers to help their employees understand the true value of their total compensation packages.

How Do We Price Our Plans?

We price our plans based on the size of your company.

Companies up to 5 - Always free

Companies from 6- 25 $2,400 annually

Companies from 26 - 50 $5,800 annually

Companies from 50 + Custom Priced

Do we charge for a set up?

For the free plan - if you would like us to set up your plan/software we charge $299.00

If you have a fully paid plan, we set up the software and give your the reports

Who do we work with to set up your plan?

We typically work with your bookkeeper, your CFO or your accountant. We are not opposed to work directly with the business owners or partners, however the bookkeepers usually know the numbers and benefits.

All we need to do is to have your bookkeeper fill out our form and we will do the rest. If you have a lot of complicated benefits we will either review your Employee Handbook or will do an interview with who knows your benefits.

What type of privacy can you expect on the Total Comp Reports?

You decide on who will have access to the sofware and what reports they can see and download. If you would like us to wall off access to any reports, we can set up access for only you. You would then decide on which employee reports you download and share. If you like the idea of automation we can always set up automatic delivery.

What client say about us

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled.

Darcel Ballentine

Barone LLC.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled.

Leatrice Handler

Acme Co.